26 de Aug 2021 | Cocoa

Trends in the main coffee markets

In Germany 51% of households have a coffee maker, in the United Kingdom there are more than 26 thousand coffee shops, the United States consumes 400 million cups of coffee a year.

On the second day of the Green Coffee Summit 2021, organized by the Specialty Coffee Association (SCA), invited experts spoke about consumption patterns in the markets of: Germany, the United Kingdom, South Korea and the United States, as well Bruno Giestas, commercial director of the Brazilian Association of Soluble Coffees (ABICS) participated, who presented the initiatives of Brazil to conquer potential consumers in emerging markets of Latin America and Asia.

Germany, the country of thinker poets and coffee growers, is a powerhouse in the importation of green coffee, which processes to offer mainly roasted coffee beans or ground coffee to its local consumers, along with an offer of innovative machines for preparation and efficient marketing at large scale.

Because the German consumer prefers fresh coffee at a fair price, green coffee imports came mainly from Brazil and Vietnam: 10.4 million bags. However, there are imports of lesser magnitude from Honduras and Colombia: 2.7 million bags, destined to the specialty coffee segment (2019), where the attributes are appreciated: variety of grain, country of origin, freshness, roasting style, flavor of high quality and traceability, also the sustainability labels: fair trade, Rainforest Alliance, UTZ and 4C.

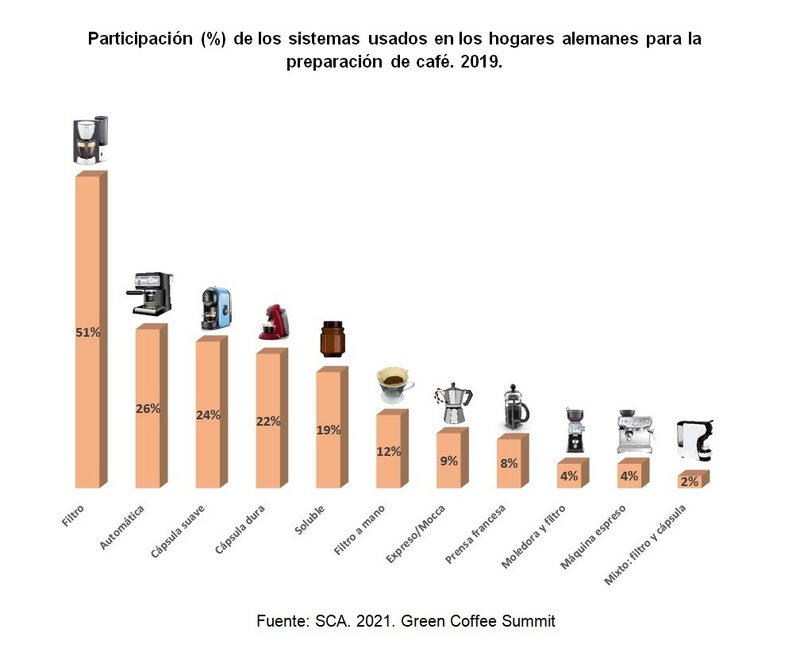

In general, consumers prefer to prepare their coffee fresh with some system. 51% of households have a semi-automatic coffee machine to filter, while only 18% prefer to consume soluble coffee (2019). For this reason, roasted coffee beans are the category that concentrates the highest value in the sector. It has even exceeded the sales volume of this category in the United States. In this context, the local coffee-making machine company: Tchibo, with more than 700 establishments in the country, has benefited.

On the other hand, coffee shops are a pillar of its culture: there are more than 28,000 coffee shops in the country. There are also 2,276 business models whose value proposition is coffee, around this product others revolve such as: light food, pastries and an atmosphere conducive to conversation (2020).

The success of the big players in the business: Coffee Fellows, Starbucks and Segafredo, has encouraged local entrepreneurs, who are making their way with businesses with a more personalized offer.

Consumption inside and outside the German home provides vibrant opportunities for actors in the conventional and specialty supply chain. This is how it feels in Hamburg, the most important green coffee import port in the country, a hub for the big traders: ECOM, Rehm Co and Neumann Kaffe Grupp.

The United Kingdom is an emerging player in the specialty coffee industry, as 80% of its consumers still prefer soluble coffee. In the country, the importation of the robust variety from Vietnam to satisfy this local demand is the most popular. About 35% of the total volume of green coffee comes from this giant, followed by Brazil (27%), Colombia (9%) and Honduras (8%).

In 2020, sales of soluble coffee and fresh coffee in the retail channel were 1.4 billion dollars and about 1.2 million dollars respectively.

Like Germany, it has a strong coffee culture: there are 26,000 stores selling coffee in the country. Despite the pandemic, it grew 1.6% (2020). Of these, 8,200 belong to the big brands: Costa Coffee, Starbucks and Greg 's Coffee. Its success has motivated entrepreneurship, which is why more and more local brands of small coffee shops are emerging, which are supplied with green coffee with traceability to serve the market niches that request this information.

South Korea has the largest coffee market in Asia, and its coffee market is the fourth largest in the world, despite its population being 26 times smaller than China's.

Only at the beginning of 2020, it imported 90,000 tons of coffee, mainly from: Brazil, Vietnam, Colombia and the United States. 58% being green coffee and the remaining 42% roasted or soluble. Recently, due to the trend of premiumization in the segment that demands unique experiences (origins and methods), it imports high quality green coffee from Costa Rica.

Since it has a mature market, the value of consumption grows faster than the volume, especially outside the home, where Koreans usually have their first encounter with coffee.

For this reason, there are more than 18,000 coffee outlets in the country (2019). Here, global brands have the highest profit margin: Ediya, Hollys Coffee, Mega Coffee. It is these actors who have popularized hot and cold drinks for day and night consumption.

The trend has also benefited soluble coffee brands: Manimy Dongsuh, the most popular for consumption within the home. Similarly, coffee-making machines have convinced the consumer that they can offer a cup of comparable quality to that of the cafeteria at a lower price, ready-to-go drinks in convenience stores as well. Therefore, the latter have increased their market share by 31% (2015-2019).

In the United States, 400 million cups of coffee were consumed in different formats, in 2020 alone. It is a country where more than 42% of households have a coffee maker and despite the boom in capsules and ready-to-drink drinks, enjoy taking the time to prepare your fresh coffee at home.

During the pandemic, this habit was consolidated and the consumption of soluble coffee was reduced. Likewise, beverages based on coffee and milk increased by 50% (2019-2020). The increase in consumption has occurred mainly in people under 40 years of age.

Although COVID-19 strongly impacted coffee shops, such as Starbucks, which lost 5.1 billion dollars in 2020, it brought the opportunity to reinvent itself as “Dunkin Donuts”, which became “Dunkin Coffee” to strengthen the position of your drink.

Brazil sees an opportunity to sell its soluble coffee in this context. In the year 2020, it produced 5.1 million bags of this product, of which 4.1 million were destined for the foreign market: being 110 the destination countries and 600 million dollars its annual income.

Thanks to having the largest soluble coffee production capacity in the world: 133,000 tons of soluble coffee per year, Brazil is making its way into emerging markets, where it is easier for a non-consumer to make the transition from tea to soluble coffee. Likewise, it manages to position itself in mature Asian markets, where the routine of work makes the practicality of soluble coffee a desirable attribute.

In the world of coffee, each market segment generates a force that promotes the development of different products and services in coffee chains: conventional and specialty. The actors who participate in them will establish different relationships according to their position. For example, it will be business-to-business (B to B) at the import level of green coffee and business-to-consumer (B to C) at the retail level of fresh (ground or bean) and soluble coffee. In both cases, the coffee buyer is different, has different needs and concerns.

Green Coffee Sumit 2021 revealed that those who are at the import level are more concerned about logistics, traceability and transparency, while those who are closer to the consumer, as in direct trade: are more concerned about specific attributes and advertising your brands in niches.

The differentiation of the relationships in the chain, business levels, market segments and product types are the fundamental steps for producing countries to develop strategies to promote their coffee in the foreign market. The Peruvian Coffee and Cacao Chamber has developed guidelines for the promotion of Peruvian coffee on this basis, in coordination with the Swiss Cooperation and within the framework of the Sustainable and Competitive Coffee Alliance Project.

_________________________________________________________________________

Sources:

Panelists